Download Oracle E-Business Suite R12 Project Essentials.1z0-511.Pass4Sure.2018-12-13.48q.vcex

| Vendor: | Oracle |

| Exam Code: | 1z0-511 |

| Exam Name: | Oracle E-Business Suite R12 Project Essentials |

| Date: | Dec 13, 2018 |

| File Size: | 239 KB |

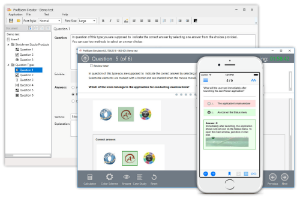

How to open VCEX files?

Files with VCEX extension can be opened by ProfExam Simulator.

Discount: 20%

Demo Questions

Question 1

Which three types of People Resources does Oracle Projects support?

- Team Roles

- Straight Time

- Jobs

- Item

- Named Person

Correct answer: ACE

Explanation:

Note:*People resources represent named persons or any grouping of named persons(E)by attributes such as job(C), organization, or role(A), whose time (effort) capacity is consumed to complete the project work. Example: Amy Marlin Note:

*People resources represent named persons or any grouping of named persons(E)by attributes such as job(C), organization, or role(A), whose time (effort) capacity is consumed to complete the project work. Example: Amy Marlin

Question 2

Identify three adjustment actions that require submission of Distribute costs program to process the adjustments?

- Change Comment

- Release Hold

- Split

- Transfer

- Recalculate Revenue

- Capitalizable to Non-Capitalizable

Correct answer: CDF

Explanation:

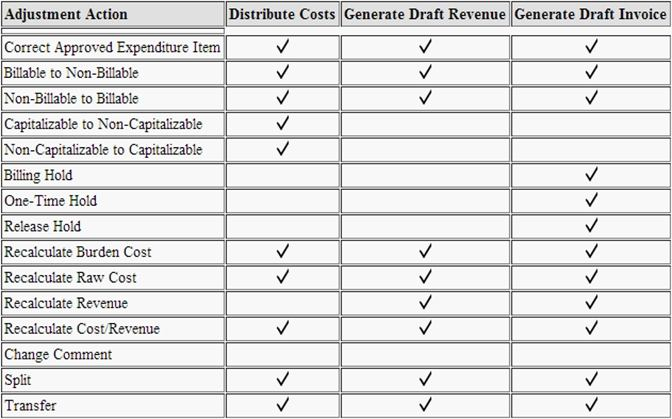

After you have performed the adjustment actions, you need to run the appropriate processes to process the adjustments. The table below notes what processes to run to process each adjustment action. After you have performed the adjustment actions, you need to run the appropriate processes to process the adjustments.

The table below notes what processes to run to process each adjustment action.

Question 3

A customer has gone into bankruptcy and is unable to pay their bills. This means that the project revenue is now overstated. How can the customer reduce the revenue on the project to accurately reflect the amount of collectable revenue?

- Create a revenue write-off event for the uncollectable element and interface to General Ledger.

- Create a negative funding line and assign to the project thus reducing its revenue.

- Create a cost adjustment on the project using preapproved batches.

- Create a credit memo in Oracle Projects and interface to Accounts Receivable.

- Enter a transaction control against the expenditure types and regenerate the draft invoice.

Correct answer: A

Question 4

What must be defined to enable a company to use an organization for a straight time expenditure?

- Define the organization with the following:1. Add Cost Centre as the Organization type.2. Add an organization classification of HR Organization.3. Add the organization to an organization hierarchy.

- Define the organization with the following:1. Add the organization classifications HR Organization and Project Expenditure/Event2.Add the organization to an organization hierarchy3. Add the organization hierarchy to the appropriate Oracle project implementation option setting

- Define the organization with the following:1.Add the organization classifications Project/Task Owning Organization and Project Expenditure/Event Organization.2. Add the organization to an organization hierarchy.3.Add the organization hierarchy to the appropriate Oracle project implementation option setting.

- Define the organization with the following:1. Add the organization classifications Project Expenditure/Event Organization.2. Add the organization to an organization hierarchy.3.Add the organization hierarchy to the appropriate Oracle project implementation option setting.

- Define the organization with the following:1. Add the organization classifications HR Organization and Project Expenditure/Event2. Add the organization to an organization hierarchy.3. Define Organization Labor Costing Rules.

Correct answer: E

Explanation:

Note:*You can set this at the Inventory Organization level in the Project Manufacturing Parameters window, the Costing tabbed region. This allows WIP employee resources and Project straight time hours to be summarized as Straight Time Expenditure Type Class. *expenditure type class An additional classification for expenditure types that indicates how Oracle Projects processes the expenditure types. For example, if you run the Distribute Labor Costs process, Oracle Projects will calculate the cost of all expenditure items assigned to the Straight Time expenditure type class. Formerly known as system linkage Note:

*You can set this at the Inventory Organization level in the Project Manufacturing Parameters window, the Costing tabbed region. This allows WIP employee resources and Project straight time hours to be summarized as Straight Time Expenditure Type Class.

*expenditure type class

An additional classification for expenditure types that indicates how Oracle Projects processes the expenditure types. For example, if you run the Distribute Labor Costs process, Oracle Projects will calculate the cost of all expenditure items assigned to the Straight Time expenditure type class. Formerly known as system linkage

Question 5

A customer has two operating units: US and Ireland. A project that is set in the Ireland operating unit requires the services of employees from the US operating unit.

Identify three mandatory steps that must be completed for the employees in the US to enter their time on the project and for costs to be successfully distributed.

- Set up Internal Billing Implementation options in US and Ireland.

- Define provider controls in US and receiver controls in Ireland.

- Setup a new transaction source to receive Intercompany transactions in Ireland.

- For the project in Ireland, select "Allow Cross Charges to all Operating Units within Legal Entity".

- For the project in Ireland,set up transaction controls to allow charges from other operating units.

Correct answer: BCD

Explanation:

B:Provider and Receiver Controls SetupFor each provider operating unit or receiver operating unit involved in the cross charge, the Provider/Receiver Controls window Provider Controls and Receiver Controls tabs specify:The cross charge method to use to process intercompany cross charges and to override default cross charge method for inter-operating unit cross charges. Attributes required for the provider operating unit to process intercompany billing to each receiver operating unit. This includes the Intercompany Billing Project and Invoice Group. Attributes required for the receiver operating unit to process intercompany billing from each provider operating unit. This includes the supplier site, expenditure type and expenditure organization. * (C) Intercompany Billing Accounting Companies choose the intercompany billing method largely due to legal and statutory requirements. When you use this method, Oracle Projects generates physical invoices and corresponding accounting entries at legal transfer prices between the internal seller(provider) and buyer (receiver) organizations when they cross a legal entity boundary or operating units. * (D) Overview of Cross Charge When projects share resources within an enterprise, it is common to see those resources shared across organization and country boundaries. Further, project managers may also divide the work into multiple projects for easier execution and management. The legal, statutory, or managerial accounting requirements of such projects often present complex operational control, billing, and accounting challenges. Oracle Projects enables companies to meet these challenges by providing timely information for effective project management. Project managers can easily view the current total costs of the project, while customers receive bills as costs are incurred, regardless of who performs the work or where it is performed. B:Provider and Receiver Controls Setup

For each provider operating unit or receiver operating unit involved in the cross charge, the Provider/Receiver Controls window Provider Controls and Receiver Controls tabs specify:

The cross charge method to use to process intercompany cross charges and to override default cross charge method for inter-operating unit cross charges.

Attributes required for the provider operating unit to process intercompany billing to each receiver operating unit. This includes the Intercompany Billing Project and Invoice Group.

Attributes required for the receiver operating unit to process intercompany billing from each provider operating unit. This includes the supplier site, expenditure type and expenditure organization.

* (C) Intercompany Billing Accounting

Companies choose the intercompany billing method largely due to legal and statutory requirements. When you use this method, Oracle Projects generates physical invoices and corresponding accounting entries at legal transfer prices between the internal seller(provider) and buyer (receiver) organizations when they cross a legal entity boundary or operating units.

* (D) Overview of Cross Charge

When projects share resources within an enterprise, it is common to see those resources shared across organization and country boundaries. Further, project managers may also divide the work into multiple projects for easier execution and management. The legal, statutory, or managerial accounting requirements of such projects often present complex operational control, billing, and accounting challenges.

Oracle Projects enables companies to meet these challenges by providing timely information for effective project management. Project managers can easily view the current total costs of the project, while customers receive bills as costs are incurred, regardless of who performs the work or where it is performed.

Question 6

A project is undertaken for a customer where all labor costs are non-billable, and Non-Labor costs are billable if the accumulated costs incurred are greater than $10k.

How can Oracle Projects be implemented to support this?

- Use transaction controls to restrict billing to Non-Labor elements and to calculate the bill amounts on Non-Labor.

- Use transaction controls to billing Non-Labor elements, capture the value on the project, and then use the Non-Labor billing extension to calculate when an activity is billable.

- Create an agreement and funding for $10k only, and fund only those tasks on a project where you estimate to incur costs of $10k or more.

- Use the cost-to-cost billing extension to build billing rules to meet the requirement.

- Use the cost accrual extension.

Correct answer: B

Question 7

An organization posts project costs to the balance sheet as they are incurred. Each month they recognize project revenue on each project.

Select the option that ensures that costs are credited from the balance sheet and debited to profit and loss as revenue is recognized.

- Use events for project revenue and use GL journals to carry out the relevant account postings.

- Implement a project revenue extension with appropriate event types and AutoAccounting definition.

- Use miscellaneous transactions to generate revenue with the appropriate AutoAccounting definition.

- Use preapproved batches with a class type of "Work in Process" to generate revenue with the appropriate AutoAccounting definition.

Correct answer: B

Question 8

Company ABC wants to deploy workplan task structures where the lowest tasks represent deliverables. They want to collect costs at a level higher than the lowest tasks for groups of deliverables. Which two task structure relationships are available for them to consider?

- Define the structures as Fully Shared.

- Utilize Task-based mapping structures.

- Define a separate branch of task hierarchy for deliverables.

- Define a separate branch of task hierarchy for cost collection.

- Define the structures as Partially shared.

Correct answer: BC

Explanation:

Note:You can set up two types of project structures in Oracle Projects:Workplan structures consist of tasks that help project managers and team members plan, track, and deliver projects on time. Financial structures consist of tasks that help project managers and financial administrators track billing, costs, budgets, and other financial information for individual projects. If you enable both a workplan structure and a financial structure for your project or project template, you can decide whether or not they are integrated, and if so, to what degree. You do this by choosing one of the following options on the Structures setup page:Shared Structures: Enables you to generate a financial structure with a task hierarchy that is fully shared by the workplan structure task hierarchy. Workplan and financial structures are fully shared by default.Partially Shared Structures: Enables you to generate a financial structure that is partially shared by the workplan structure hierarchy.Non-Shared: Task-Based Mapping: Enables you to map individual workplan structure tasks to individual financial structure tasks.Non-Shared: No Mapping: Choose this if you do not want to integrate your project workplan and financial structures in any way. Note:

- You can set up two types of project structures in Oracle Projects:

- Workplan structures consist of tasks that help project managers and team members plan, track, and deliver projects on time.

- Financial structures consist of tasks that help project managers and financial administrators track billing, costs, budgets, and other financial information for individual projects.

- If you enable both a workplan structure and a financial structure for your project or project template, you can decide whether or not they are integrated, and if so, to what degree. You do this by choosing one of the following options on the Structures setup page:

- Shared Structures: Enables you to generate a financial structure with a task hierarchy that is fully shared by the workplan structure task hierarchy. Workplan and financial structures are fully shared by default.

- Partially Shared Structures: Enables you to generate a financial structure that is partially shared by the workplan structure hierarchy.

- Non-Shared: Task-Based Mapping: Enables you to map individual workplan structure tasks to individual financial structure tasks.

- Non-Shared: No Mapping: Choose this if you do not want to integrate your project workplan and financial structures in any way.

Question 9

A US-based company is providing resources to a UK subsidiary and has implemented Oracle Projects intercompany billing solutions. How would the US company create the Accounts Payable invoice in the UK operating unit?

- when the draft intercompany invoice is approved in the us Projects ledger

- when the draft intercompany revenue is approved in the US Projects ledger

- Invoice automatically created as part of the PRC: Tieback Invoices from Receivables in the US Project ledger

- when the draft intercompany invoice is released in the US Projects Ledger

- on creation of the Intercompany revenue in the US General Ledger

Correct answer: C

Explanation:

The provider operating unit runs the process PRC: Tieback Invoices from Receivables, which automatically creates corresponding intercompany invoice supplier invoices ready to be interfaced to Oracle Payables in the receiver operating unit.Note:See step 6 below. Intercompany Billing Processing Flow Intercompany billing processing requires the following steps:The provider operating unit also imports project-related supplier costs from Oracle Purchasing and Oracle Payables and project-related expense report costs from Oracle Payables. Use Oracle Receivables to print the invoice as well as to create accounting for Oracle Subledger Accounting. The provider operating unit runs the process PRC: Tieback Invoices from Receivables, which automatically creates corresponding intercompany invoice supplier invoices ready to be interfaced to Oracle Payables in the receiver operating unit.

Note:

See step 6 below.

Intercompany Billing Processing Flow Intercompany billing processing requires the following steps:

The provider operating unit also imports project-related supplier costs from Oracle Purchasing and Oracle Payables and project-related expense report costs from Oracle Payables.

Use Oracle Receivables to print the invoice as well as to create accounting for Oracle Subledger Accounting.

Question 10

You have defined a Non-Labor resource "Mini Truck" with an expenditure type "Vehicle" that has a rate of $100. This resource is attached to three Non-Labor resource organizations: "Construction-East," "Construction-West," and "Construction-Central."

How do you set up a rate of $150 for usage charges when the "Mini Truck" owned by "Construction-Central" is charged to a project?

- In the Project setup, enter a rate of $150 for "Construction-Central" in the organization overrides.

- In the Non-Labor resources setup, select the "Construction-Central" organization and enter a rate of $150.

- Create a new rate schedule with a rate of $150 for "Mini Truck" and attach it to the project.

- Create a new rate schedule with a rate of $150 for "Mini Truck" and attach it to"Construction-Central."

- Write custom code in Non-Labor cost override extension.

Correct answer: D

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

HOW TO OPEN VCEX AND EXAM FILES

Use ProfExam Simulator to open VCEX and EXAM files

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!