Download Certified Valuation Analyst.CVA.CertDumps.2018-01-09.251q.vcex

| Vendor: | Financial |

| Exam Code: | CVA |

| Exam Name: | Certified Valuation Analyst |

| Date: | Jan 09, 2018 |

| File Size: | 330 KB |

How to open VCEX files?

Files with VCEX extension can be opened by ProfExam Simulator.

Discount: 20%

Demo Questions

Question 1

The United State is by far the world leader in markets for both publicly traded securities and closely held businesses and business interests. Two factors have combined to accelerate the spread of U.S technology in financial appraisals and market throughout the world. Which of the following is/are of those factors?

- Rapidly increasing international flow of capital

- Growing privatization of formerly socially owned businesses in almost every country of the world.

- Increased inflation in major parts of the world

- Secondary market securities trading phenomenon

Correct answer: AB

Question 2

When specifying, who is to provide the valuation services, the important distinction is whether the client is retaining the appraisal firm itself or the individual appraiser employed by the firm. The common practice is:

- To retain the individual appraiser rather than the firm

- To retain the firm rather than individual appraiser, even though the expert witnesses testify based upon their individual expertise and opinions

- To retain the individual since the firm is responsible for completing the assignment regardless of impairment the individual’s capability to perform the work

- To retain firm as such practice also tends to provide discontinuity in retention of working papers and related records, marking them accessible if they are needed months or even years later as they frequently are

Correct answer: B

Question 3

S corporations, limited liability corporations, limited liability partnerships, family limited partnerships, professional corporations, real estate investment trust, investment companies registered under the investment company act of 1940 and personal holding companies are the examples of:

- General and limited partnerships

- Cooperatives

- Entities’ structures giving rise to special legal or tax considerations (specified structure)

- Companies following valuation standards

Correct answer: C

Question 4

The definition of specific business interest can be broken down into two broad questions:

- Is the valuation to be a valuation of assets or a valuation of securities?

- In either case, exactly what assets or what securities are subject to valuation? By securities in above context, we mean:

- Ownership interests; such as marketable securities and commercial papers

- Ownership interests; such as stock, depth and partnership interests

- Partnership interests

- Equity or invested capital

Correct answer: B

Question 5

Valuation of ___________must be specified. For example, the assignment might include language such as” ...engaged to estimate the fair market value of the fixed assets, inventory, and goodwill, on a going-concern basis of...”

- Assets

- Securities

- Cooperatives

- Partnerships

Correct answer: A

Question 6

Which one of the following is NOT always clearly defined? Therefore, if the term is used, it should be supplemented by a definition of exactly what it means in the given valuation context.

- Enterprise value

- Partial interest

- Invested capital

- Securities

Correct answer: C

Question 7

Unfortunately, the term enterprise value is used, at best, very ambiguously and, at worst, very carelessly. It means different things to different people, each of whom many believe that his or her definition is the right definition. It is generally used to represent some sort of ________of the company and is often used as a synonym for_______.

- Average value, Market value

- Aggregate value, Market value of invested capital (MVIC)

- Partial interest, Aggregate value

- Specific ownership interest subject to appraisal, Equity or invested capital

Correct answer: B

Question 8

The primary ownership interest characteristics that need to be addressed in almost every business valuation are the following EXCEPT:

- Control or minority valuation basis (not necessarily a black-and–white issue ____there may be elements of control without absolute control

- Degree of marketability

- Fair market value

- Fair market value on a nonmarketable, non-controlling ownership interest basis.

Correct answer: CD

Question 9

In most business valuations, the opinion of value will be based at least partly on other, similar transactions, such as:

- Prices at which stocks are denominated

- Degree of marketability

- Prices at which stocks in the same or a related industry are trading in the public market relative to their earnings, assets, dividends or other relative variables

- Black-or-white issues

Correct answer: C

Question 10

In a marital dissolution the parties may be concerned with the change in value that occurred during the marriage. In estate cases, the trustee, the executer, or personal representative will consider adopting the “alternative valuation date” (i.e. six months after the date of death) to determine which is more advantageous. These are the examples of:

- Situations identifying valuation date

- Situations having more than one valuation dates

- Litigated cases

- Universally applicable methods to finalize valuation date

Correct answer: B

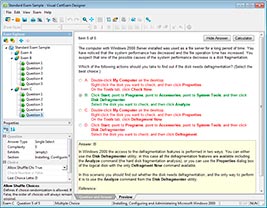

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

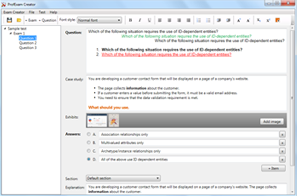

HOW TO OPEN VCEX AND EXAM FILES

Use ProfExam Simulator to open VCEX and EXAM files

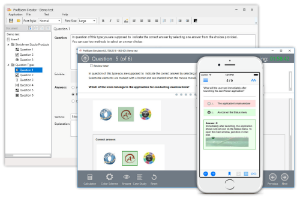

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!