Download P1 Management Accounting).CIMAPRO15-P01-X1-ENG.CertKey.2019-04-04.33q.vcex

| Vendor: | CIMA |

| Exam Code: | CIMAPRO15-P01-X1-ENG |

| Exam Name: | P1 Management Accounting) |

| Date: | Apr 04, 2019 |

| File Size: | 1 MB |

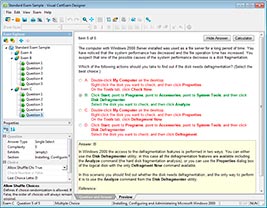

How to open VCEX files?

Files with VCEX extension can be opened by ProfExam Simulator.

Discount: 20%

Demo Questions

Question 1

A company is preparing its annual budget and is estimating the number of units of Product A that it will sell in each quarter of year 2. Past experience has shown that the trend for sales of the product is represented by the following relationship:

y = a + bx where

y = number of sales units in the quarter a = 10,000 units b = 3,000 units x = the quarter number where 1 = quarter 1 of year 1

Actual sales of Product A in Year 1 were affected by seasonal variations and were as follows:

Quarter 1:14,000 units Quarter2: 18,000 units Quarter 3: 18,000 units Quarter 4: 20,000 units

Calculate the expected sales of Product A (in units) for each quarter of year 2, after adjusting for seasonal variations using the additive model.

- The expected sales for year 2 Quarter 4 was 32700 units

- The expected sales for year 2 Quarter 4 was 32000 units

- The expected sales for year 2 Quarter 4 was 33000 units

- The expected sales for year 2 Quarter 4 was 40000 units

Correct answer: B

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-11-ero/ Reference: https://www.vrelearnonline.com/cima-p1-103-11-ero/

Question 2

‘A zero-based budgeting system involves establishing decision packages that are then ranked in order of their relative importance in meeting the organization’s objectives’.

Which of the following is true regarding he difficulties that a not-for-profit organization may experience when trying to rank decision packages.

Select ALL true statements.

- The activities that are being proposed in a budget are described in variable packages. There will often be more less than one decision package proposed for an activity.

- The activities that are being proposed in a budget are described in decision packages. There will often be more than one decision package proposed for an activity.

- Some of these packages will be inclusive and will require operations to select the best solution to the issue involved.

- Some of these packages will be mutually inclusive and will require management to select the best solution to the issue involved.

- Each decision package is evaluated. Its costs are compared to its benefits and net present values or other measures calculated.

- Management may decide to reject packages even though the activity was done last year. In this way the organization is said to be starting from a zero base with each package given due consideration.

- Management may decide to accept packages even though the activity was done last year. In this way the organization is said to be starting from a 100% cost base with each package given due consideration.

- In a public sector body, for example, decision packages will relate profit making activities.

- In a public sector body, for example, decision packages will relate to very disparate activities.

Correct answer: BDEFI

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-17/ Reference: https://www.vrelearnonline.com/cima-p1-103-17/

Question 3

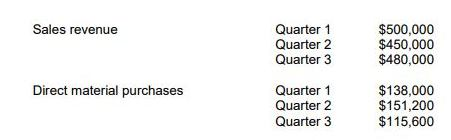

JL is preparing its cash budget for the next three quarters. The following data have

been extracted from the operational budgets:

Additional information is available as follows:

- JL sells 20% of its goods for cash. Of the remaining sales value, 70% is received within the same quarter as sale and 30% is received in the following quarter. It is estimated that trade receivables will be $125,000 at the beginning of Quarter 1. No bad debts are anticipated.

- 50% of payments for direct material purchases are made in the quarter of purchase, with the remaining 50% in the quarter following purchase. It is estimated that the amount owing for direct material purchases will be $60,000 at the beginning of Quarter 1.

- JL pays labour and overhead costs when they are incurred. It has been estimated that labour and overhead costs in total will be $303,600 per quarter. This figure includes depreciation of $19,600.

- JL expects to repay a loan of $100,000 in Quarter 3.

- The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive.

Required:

Prepare a cash budget for each of the THREE quarters.

What will the closing balance of cash flows in quarter THREE be?

- $100 200

- $170 400

- $145 000

- $150 200

- $130 200

- $160 690

- $184 900

Correct answer: E

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-q19/ Reference: https://www.vrelearnonline.com/cima-p1-103-q19/

Question 4

Assume that you have made profit calculations based on standard profit calculation methods and activity based costing methods.

In which ways will this information be beneficial to the management team?

Select all the true statements.

- Under an activity based costing system the various support activities that are involved in the process of making products or providing services are identified.

- The cost drivers that cause a change to the cost of activities are also identified and used as the basis to attach activity costs to a particular product or service.

- Through the tracing of costs to product in this way ABC establishes less accurate costs for the product or service.

- The identification of cost drivers provides information to management to enable them to take actions to improve the overall profitability of the company.

- Operational analysis will provide information to management on how costs can be incurred and managed.

Correct answer: ABD

Question 5

Explain the advantages of management participation in budget setting and the potential problems that may arise in the use of the resulting budget as a control mechanism.

Select all the correct answers.

- A purposes of budgeting is to act as a control mechanism, with actual results being compared against budget.

- Another purpose of a budget is to set targets to motivate managers and optimize their performance.

- The participation of managers in the budget setting process has several advantages. Managers are more likely to be motivated to achieve the target if they have participated in setting process has several advantages. managers are more likely to be motivated to achieve the target if they have participated in setting the target.

- Participation in budget setting can reduce the information asymmetry gap that can arise when targets are imposed by senior management. Imposed targets are likely to make managers feel demotivated and alienated and result in poor performance.

- Participation in budget setting can cause problems; in particular, managers may attempt to negotiate budgets that they feel are easy to achieve which gives rise to “budget padding” or budgetary slack.

- Managers will not ‘empire build’ because they don’t believe that the size of their budget reflects their importance within the organization.

Correct answer: ABCDE

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-26/ Reference: https://www.vrelearnonline.com/cima-p1-103-26/

Question 6

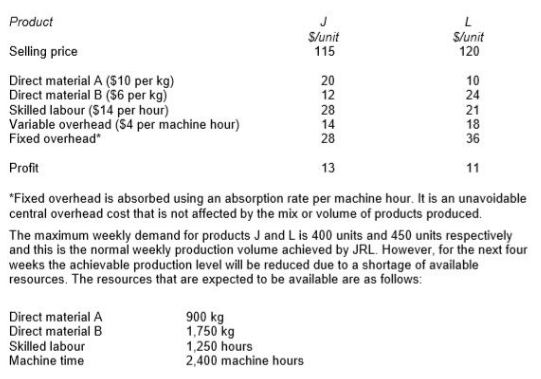

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

* Refer to your answer in the previous question.

The optimal solution to the previous question shows that the shadow prices of skilled labour and direct material A are as follows:

Skilled labour $ Nil Direct Material A $11.70

Explain the relevance of these values to the management of JRL.

Select ALL the true statements.

- The shadow price equals the additional contribution that would be earned from one extra unit of a scarce resource.

- In a situation such as this, where a number of resources are scarce, the shadow price of any particular scarce resource will depend on whether or not the resource is not binding.

- The shadow price for skilled labour is NIL because although there is a shortage of skilled labour it does have a constraining effect on output of JR as other resources are more scarce.

- Since material A is one of the binding constraints, if the availability of material A could be increased by one unit, this would change the optimal plan.

- The decrease in contribution as a result of this change is the value of the shadow price of material A. The shadow price thus represents the maximum premium that should be paid for an additional unit of material A.

Correct answer: AD

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-28/ Reference: https://www.vrelearnonline.com/cima-p1-103-28/

Question 7

A master budget comprises the...

- budgeted income statement and budgeted cash flow statement only.

- budgeted income statement and budgeted balance sheet only.

- budgeted income statement and budgeted capital expenditure only

- budgeted income statement, budgeted balance sheet and budgeted cash flow statement only.

Correct answer: D

Explanation:

Reference: https://www.vrelearnonline.com/cima-p1-103-29/ Reference:

https://www.vrelearnonline.com/cima-p1-103-29/

Question 8

RFT, an engineering company, has been asked to provide a quotation for a contract to build a new engine. The potential customer is not a current customer of RFT, but the directors of RFT are keen to try and win the contract as they believe that this may lead to more contracts in the future. As a result, they intend pricing the contract using relevant costs. The following information has been obtained from a two-hour meeting that the Production Director of RFT had with the potential customer. The Production Director is paid an annual salary equivalent to $1,200 per 8-hour day. 110 square meters of material A will be required. This is a material that is regularly used by RFT and there are 200 square meters currently in inventory. These were bought at a cost of $12 per square meter. They have a resale value of $10.50 per square meter and their current replacement cost is $12.50 per square meter. 30 liters of material B will be required. This material will have to be purchased for the contract because it is not otherwise used by RFT. The minimum order quantity from the supplier is 40 liters at a cost of $9 per liter. RFT does not expect to have any use for any of this material that remains after this contract is completed. 60 components will be required. These will be purchased from HY. The purchase price is $50 per component. A total of 235 direct labour hours will be required. The current wage rate for the appropriate grade of direct labour is $11 per hour. Currently RFT has 75 direct labour hours of spare capacity at this grade that is being paid under a guaranteed wage agreement. The additional hours would need to be obtained by either (i) overtime at a total cost of $14 per hour; or (ii) recruiting temporary staff at a cost of $12 per hour. However, if temporary staff are used they will not be as experienced as RFT’s existing workers and will require 10 hours supervision by an existing supervisor who would be paid overtime at a cost of $18 per hour for this work. 25 machine hours will be required. The

machine to be used is already leased for a weekly leasing cost of $600. It has a capacity of 40 hours per week. The machine has sufficient available capacity for the contract to be completed. The variable running cost of the machine is $7 per hour. The company absorbs its fixed overhead costs using an absorption rate of $20 per direct labour hour.

Select ALL the true statements.

- The cost for the production director meeting was a relevant cost.

- Material A was a relevant cost.

- Material B was a relevant cost.

- The components are to be purchased from HY at a cost of $50 each. This is a relevant cost because it is future expenditure that will be incurred as a result of the work being undertaken.

- The machine is currently being leased and it has spare capacity so it will either stand idle or be used on this work. The lease cost will be a relevant cost or $10 per hour.

- The company absorbs its fixed overhead costs using an absorption rate of $20 per direct labour hour. This is a relevant cost.

- The relevant cost is $7010

- The relevant cost is $7080

- The relevant cost is $7100

Correct answer: BCDG

Explanation:

Reference: https://www.vrelearnonline.com/p1-103-3-hgo/ Reference: https://www.vrelearnonline.com/p1-103-3-hgo/

Question 9

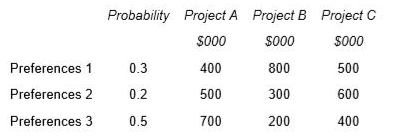

A company has to choose between three mutually exclusive projects. Market research has shown that customers could react to the projects in three different ways depending on their preferences. There is a 30% chance that customers will exhibit preferences 1, a 20% chance they will exhibit preferences 2 and a 50% chance they will exhibit preferences 3. The company uses expected value to make this type of decision.

The net present value of each of the possible outcomes is as follows:

A market research company believes it can provide perfect information about the preferences of customers in this market.

What is the maximum amount that should be paid for the information from the market research company?

- $145 000

- $140 000

- $125 000

- $135 000

Correct answer: B

Explanation:

Reference: https://www.vrelearnonline.com/p1-103-4-azr/ Reference: https://www.vrelearnonline.com/p1-103-4-azr/

Question 10

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company’s planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company’s normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning.

The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

Select ALL the benefits for the company that could occur following the introduction of an activity based budgeting system.

- Under an activity based budgeting system, resource allocation is linked to the strategic plan is prepared after considering alternative strategies. This approach ensures that new activities that are required to meet the company’s strategic objectives are included in the budget.

- Under an activity based budgeting system the focus is on existing resources and operations. Adjustments are then made for changes in activity and price which results in past inefficiencies being perpetuated. Under a traditional budgeting system, only resources that are needed to perform activities required to meet the budgeted production and sales volumes are included.

- Activity based techniques including activity based budgeting focus on the outputs of a process rather than the input to the process. This approach provides a clear framework for understanding the link between costs and the level of activity. It allows the ranking of activities and the determination of how limited resources should be allocated across competing activities.

- ABB systems present costs under functional headings i.e. the emphasis is on the nature of the cost. The weakness of this approach is that it gives little indication of the link between the level of activity and the cost incurred.

- The approach under an activity based system is to make arbitrary cuts in order to meet overall financial targets.

- Activity based budgeting allows the identification of value added and non-value added activities and ensures that cuts are made to non-value added activities. ABB is also useful for review of capacity utilization.

Correct answer: ACDF

Explanation:

Reference: https://www.vrelearnonline.com/p1-103-5-ert/ Reference: https://www.vrelearnonline.com/p1-103-5-ert/

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

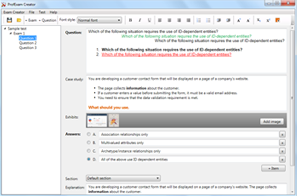

HOW TO OPEN VCEX AND EXAM FILES

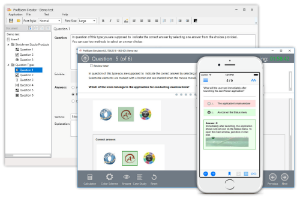

Use ProfExam Simulator to open VCEX and EXAM files

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!