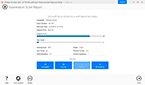

Download ACI DEALING CERTIFICATE.3i0-008.SelfTestEngine.2019-03-15.304q.vcex

| Vendor: | ACI |

| Exam Code: | 3i0-008 |

| Exam Name: | ACI DEALING CERTIFICATE |

| Date: | Mar 15, 2019 |

| File Size: | 186 KB |

| Downloads: | 8 |

How to open VCEX files?

Files with VCEX extension can be opened by ProfExam Simulator.

Discount: 20%

Demo Questions

Question 1

Click on the Exhibit Button to view the Formula Sheet. Which of the following are transferable instruments?

- Eurocertificate of deposit

- US Treasury bill

- CP

- All of the above

Correct answer: D

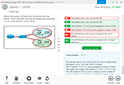

Question 2

Click on the Exhibit Button to view the Formula Sheet. Bank A pays for EURO 5 m at 1.1592. Bank B offers EURO 10 m at 1.1597. Broker XYZ quotes to the market EURO / USD 1.1592/97. Bank C takes the offer at 97. The broker is obliged to reveal:

- The name of Banks A and B.

- The name of Bank B only.

- The amount that was bid but not the name of Bank A

- None of the above

Correct answer: B

Question 3

Click on the Exhibit Button to view the Formula Sheet. Which of the following statements reflects the Model Code on gambling or betting amongst market participants?

- Gambling and betting between market participants s

- Gambling and betting between market participants c

- Gambling and betting between market participants s

- All of the above.

Correct answer: A

Question 4

Click on the Exhibit Button to view the Formula Sheet. Your are quoted the following rates: spot CHF/JPY 80.12-22 3M CHF/JPY 25.5/22.5 At what rate can you buy 3-month outright JPY against CHF?

- 79.995

- 79.965

- 79.895

- 79.865

Correct answer: D

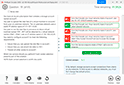

Question 5

Click on the Exhibit Button to view the Formula Sheet. You quote a price to a broker on EUR 100 million. Your price is hit for EUR 50 million.

What does the Model Code say about this situation?

- You have a right to qualify your quotes in terms o

- You have a right to qualify your quotes in terms o

- You have a right to qualify your quotes in terms o

- You have a right to qualify your quotes in terms o

Correct answer: A

Question 6

Click on the Exhibit Button to view the Formula Sheet. Written confirmation is a function that can be done by:

- Any dealer as long as he/she is not a party to the

- Staff in the back-office.

- Staff in the dealing room who are not dealing.

- Any staff outside the dealing room.

Correct answer: B

Question 7

Click on the Exhibit Button to view the Formula Sheet. A forward-forward loan creates an exposure to the risk of:

- Higher interest rates

- Lower interest rates

- Steepening yield curve

- Parallel shift downwards in the yield curve

Correct answer: A

Question 8

Click on the Exhibit Button to view the Formula Sheet. What is meant by "short dates"?

- Maturities of less than one week.

- Maturities of less than one month.

- Maturities of less than one year.

- Maturities in the same calendar month.

Correct answer: B

Question 9

Click on the Exhibit Button to view the Formula Sheet. What is the Gold Offered Forward Rate?

- The price differential between spot and forward go

- The rate at which dealers will lend gold against U

- The implied forward price of gold

- The price of gold for forward delivery

Correct answer: B

Question 10

Click on the Exhibit Button to view the Formula Sheet. Confirmations should be sent out by both counterparties through an efficient and secure means of communication, preferably electronic:

- Within 24 hours of the deal.

- Within two business days of the deal.

- Before the value date.

- As soon as possible.

Correct answer: D

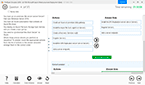

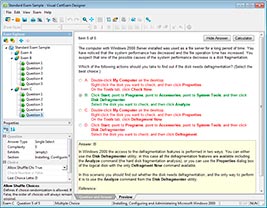

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

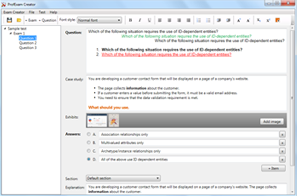

HOW TO OPEN VCEX AND EXAM FILES

Use ProfExam Simulator to open VCEX and EXAM files

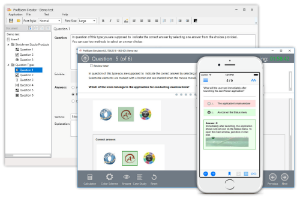

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!